- #Tds deduction in salary slip how to#

- #Tds deduction in salary slip professional#

- #Tds deduction in salary slip download#

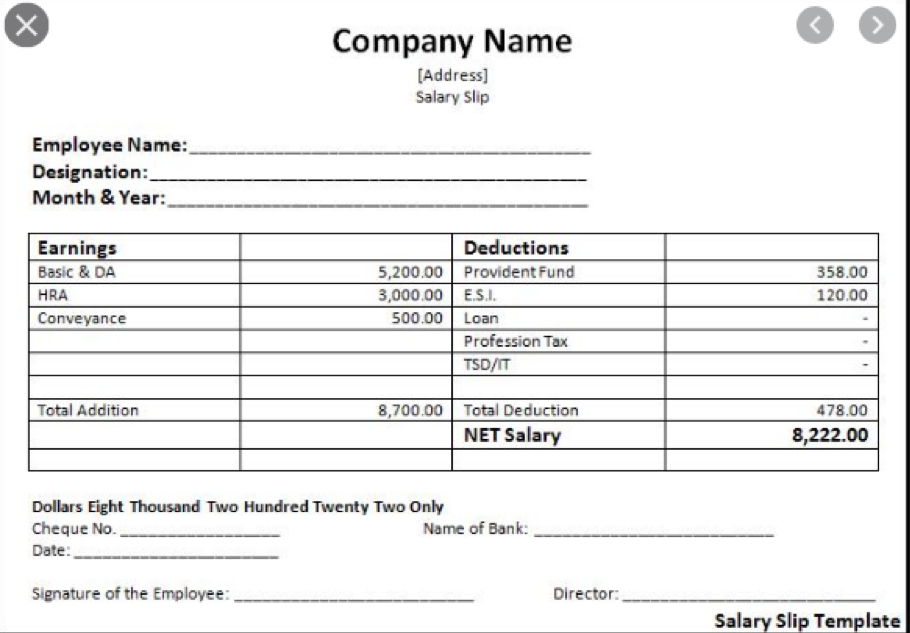

There might be possibilities that - some companies pay in cash, some in cheques, and some provide salary through bank transfer. Predefined salary slips templatesĪ salary slip is different for the organization and industry. So, the salary slip format also contains these details.Įmployee's deduction is deducted from the gross salary.

#Tds deduction in salary slip professional#

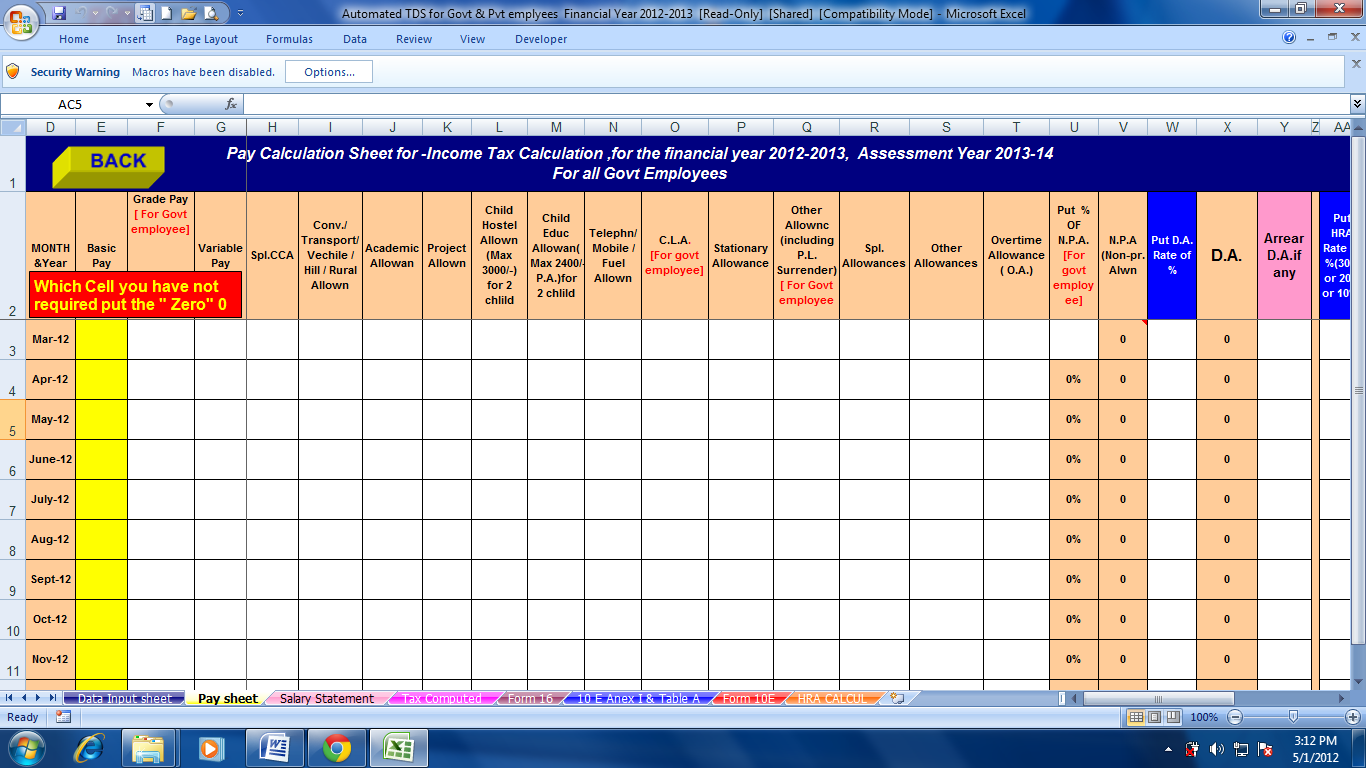

Deductions like - PF (Provident fund), TDS, Loan, EMI, HRA (Home Rent Allowance), Health Insurance, professional taxes, advance salary, etc. With earning, there might be some deduction as well. It includes basic salary, allowances (Conveyance allowance, Dearness allowance, medical allowance, travel allowance, HRA), Performance bonus, and other benefits. In some formats date of joining is also a part of the salary slip.Īfter the company and employee details, let's move to the earnings. Employee name, Employee ID, designation, bank account details, and Employee net pay. It generally includes the company name, address, and contact number in a payslip.Ī payslip is created for each employee separately and it must contain some payroll details of employees. So, if you want to add or remove something, you can modify it using MS-Excel software.Ī simple salary slip format contains four major details:Ī payslip always contains basic company details in it. Remember that - these formats are editable. Conversely, there are several salary slip formats and templates are available on the internet. You can prepare the salary slip in MS-Excel by yourself with a few simple steps. In contrast, a company accountant requires the salary slip to transfer the salaries of employees. If there is any correction, they can inform HR to make the corrections in it. It is either issued on paper or mailed to them on their mail ids.Įmployees can reverify all details in their salary slip, such as bank account number, total working days, and leaves. Why is the salary slip needed?Ī salary slip is created on a monthly basis and issued by the employer to the employees and company accountant. As it contains payroll details of employees so that it is also called Pay slip.Īn organization can have its own salary slip format prepared by the Accountant/HR or use a format downloaded from the internet by making some changes. A salary slip usually contains the company name, payslip month, employee name, employee ID, employee's bank account number, HRA, gross salary, provident fund, daily attendance, and many more.Īpart from these details, it can also have the employee's total working days, weekends, leave taken by him, deduction (if any), bonus, extra time work, half days, and many more details. What is a salary slip?Ī salary slip is an Excel report that is designed to keep the employee's monthly data. Thus, this chapter is designed by keeping all the salary slip-related questions in mind.

#Tds deduction in salary slip how to#

What is a salary slip? Why is it needed? How to create it? Is there any predefined salary slip format available on the internet? These are some most asked questions that come to mind.

If you want to design the format by yourself, you should know about it.

#Tds deduction in salary slip download#

You can download any of them that fits your needs and use them. You can make your own format that meets your requirements and use it forever.īesides this, there are several pre-designed salary slip formats available on the internet. It can be designed using MS-Excel software. Salary slip format is usually required in organizations to keep the monthly payroll record of the employee. Next → ← prev Salary slip format in Excel

0 kommentar(er)

0 kommentar(er)